As 2021 gears up, it’s time for employers to turn their attention to completing the confusing 1099-NEC, 1099-MISC and ACA reporting forms. They can’t all be as simple as filing W-2 forms. Here are some important changes and helpful reminders as you begin to prepare your informational returns for employees and independent contractors.

1. Familiarize Yourself with the New Form 1099-NEC, Nonemployee Compensation

The IRS has made a major change to tax reporting. Form 1099-NEC has recently been released, replacing Form 1099-MISC box 7 for reporting non-employee compensation.

Specifically, the new 1099-NEC will capture payments of $600 or more to service providers — typically work done by an independent contractor who is a sole proprietor or member of a partnership. Examples include graphic designers, Web developers, cleaning professionals, freelance writers, landscapers and other self-employed individuals. It’s important to note that you must also file Form 1099-NEC (report in box 4) for anyone you withheld federal income tax under the backup withholding rules, regardless of the amount.

2. Refamiliarize Yourself with Form 1099-MISC, Miscellaneous Income

The 1099-MISC has been redesigned due to the creation of Form 1099-NEC. Employers will no longer report nonemployee compensation, such as payments to independent contractors, on Form 1099-MISC beginning with tax year 2020.

According to the IRS, employers must file Form 1099-MISC for each person in the course of your business to whom you have paid the following during the year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in:

o Rents (box 1);

o Prizes and awards (box 3);

o Other income payments (box 3);

o Generally, the cash paid from a notional principal contract to an individual, partnership, or estate (box 3);

o Any fishing boat proceeds (box 5);

o Medical and health care payments (box 6);

o Crop insurance proceeds (box 9);

o Payments to an attorney (box 10)

o Section 409A deferrals (box 12); or

o Nonqualified deferred compensation (box 14).

3. Doublecheck Employee Information for ACA Reporting

You want to be certain the following information is documented and up to date: employee names and Social Security numbers, dependents’ dates of birth and Social Security numbers, eligibility determinations, offers of coverage, and waivers (or opt outs) of coverage. It’s a good idea to remind employees to report any name changes due to marriage or divorce to your business, as well as the Social Security Administration.

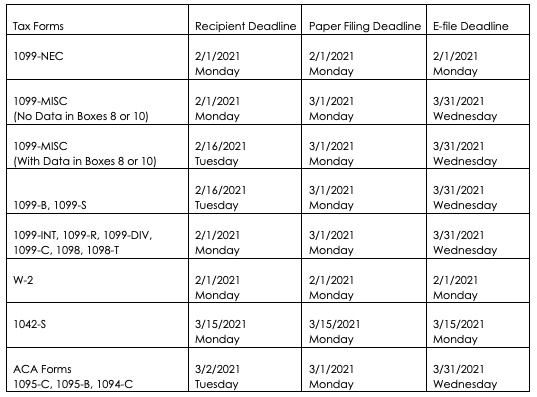

4. Know the Filing Deadlines

Simplify tax season and avoid last-minute stress by being aware of the filing deadlines. Start gathering your documents now to streamline the process.

1099, W-2, and ACA Filing Due Dates

*Dates are subject to change, please verify all dates with the IRS/SSA

.

Get the Solutions You Need

In addition to Form 1099-MISC, Form 1099-NEC and ACA reporting forms, Office Depot carries a wide variety of other tax forms, including W-2s, 1098s and 1099-INT. In fact, Office Depot can help you meet all your tax filing obligations with a full line of IRS-approved forms, envelopes, software and e-filing solutions.

|

CenterPoint Group provides discounts to key suppliers such as Office Depot, Enterprise and National Car Rental, Altour Corporate Travel, W.W. Grainger, Verizon Wireless and more... |

The contents of this article are for informational purposes only. The information should not be relied upon as replacement for professional tax advice.

Leave a Reply

Comment policy: We love comments and appreciate the time that readers spend to share ideas and give feedback. However, all comments are manually moderated and those deemed to be spam or solely promotional will be deleted.